Kai

Your KYC AI Investigator

Leverage AI to streamline your KYC workflows, reduce processing times and operational costs.

Book ConsultationFeatures

- Expert Team — Deep financial crime expertise spanning KYC/KYB, sanctions screening, fraud prevention and transaction monitoring.

- Powered by GenAI — We leverage cutting-edge technology to liberate your analysts to complete high value work.

- Seamless Integration — Effortless integration with existing systems and data sources for rapid deployment.

- Workflow Automation — Streamline your customer onboarding journeys, reducing manual effort and increasing accuracy.

- Regulatory Compliance — Guardrails and audit trails ensure auditable and explainable decisions.

- Data-Driven Insights — Real-time analytics and reporting providing actionable compliance intelligence.

How it works

- Plug and Play — Kai is designed to interact with your systems of record and existing data providers.

- Smart triggers — Kai uses smart triggers to initiate investigative journeys, which utilise various prompt engines to efficiently complete the journey in detail.

- Investigative journeys — Orchestrates prompt engines, data gathering steps, and external service calls to thoroughly examine triggered events.

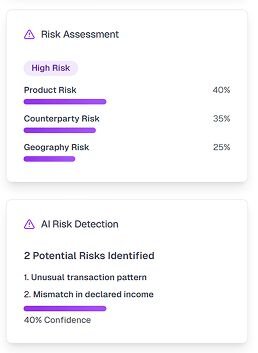

Real-Time Risk Intelligence

Get instant visibility into your risk landscape with real-time monitoring and intelligent scoring across your entire customer base.

Compliance Policy Guardrails

Kai ensures every decision aligns with your latest policies and procedures. Using advanced RAG (Retrieval Augmented Generation), it automatically references, validates, and applies the most current compliance requirements to each task.

bigspark’s Delivery Approach for Kai

- Measure and Diagnose — Assess current capabilities and understand customer behaviours and relationships.

- Prove & Validate — Implement advanced analytic tools using Gen AI and machine learning to bring operational efficiencies to the KYC processes.

- Scale & Optimise — Transition to AI and data driven KYC operations ensuring consistent regulatory compliance.

Awards and Honours